DURGA PRASAD PADHI

Imagine a remote village in Ganjam district where the morning silence was broken not by the hum of motorcycles, but by the gentle creaking of a few precious bicycles. This was my world a place where two-wheelers and four-wheelers existed only in imagination, and the occasional bus service to Berhampur was our lifeline to the outside world.

My birth took place in this remote village of Ganjam district. My primary schooling was completed in my village whereas other schooling was completed at a place near my village. During those days the village had only a few bicycles which were the primary mode of transportation and two wheelers, and four wheelers were not visible at all. Limited bus services were available at a nearby village which carried people from remote villages to Berhampur, the de-facto district headquarters of the district. During our school days there was no investment by the family for our education as there were no private tuitions nor extra guidebooks for examinations etc., whereas the other expenses for our education were met from the scholarship provided by the government for being good students.

Education was simple yet profound no private tuitions, no expensive guidebooks, just the generous scholarship from a government that believed in nurturing talent, regardless of economic background. We were grateful students, studying under the promise that education would be our pathway to something greater.

A Nation Finding Its Feet

What we experienced in our small village was merely a microcosm of India’s larger story. Similarly, at the national level the government at that time was focusing on poverty eradication and birth control. The jobs available at that time were mostly government jobs like administrative jobs, jobs available with public sector particularly public sector banks and insurance sector. Some jobs were available in health and education (doctor and teacher) sectors which were in the government sector only. Basically, the employment at that time was concentrated in the government sector only. No private sector jobs, no start-ups etc. In addition to that employment was mostly available in agriculture which was creating more disguised employment instead of employment. The SME sector was in its nascent stage with fewer employment opportunities.

The entire nation was grappling with fundamental challenges, poverty was not just a statistic but a lived reality for millions. The government was the primary employer, and for young people like me, a government job represented security, respect, and a chance to serve the community that had nurtured us.

My Banking Journey: Serving the Underserved

My profession when I joined, was mostly focused on providing banking services to the poor and needy. At village branches the job was to collect deposits from the public, provide services and provide credit to the poor for creating further employment opportunities. There we used to hear about “credit squeeze”. Loans were a very rare commodity. As the government was diverting the lendable resources of the banks to itself by way of high percentage of CRR and SLR. (CRR – Cash Reserve Ratio and SLR – Statutory Liquidity Ratio which is a % of deposits the banks maintain with RBI). As lendable resources were squeezed, so banks were preferring loans over SLR funds as SLR funds giving good returns and carrying no risk. As there was no risk in parking funds with govt securities like SLR which were also giving good returns on funds, banks mostly parking their funds in government securities and avoiding lending to the public where risk was quite high. Again, Banks were doing some directed lending (loans which are mandatorily given as per government instructions) which are schematic in nature and subsidy linked for creating employment among poor in rural and urban areas.

Those were challenging times in banking. Credit was scarce, and every loan application was scrutinized with the intensity of a precious resource allocation. We bankers found ourselves caught between the government’s need for funds and the people’s need for credit. Yet, we persevered, knowing that each small loan we approved could transform a family’s destiny.

The Remarkable Transformation

But here’s where the story becomes truly extraordinary. Fast forward to today, and the transformation is nothing short of miraculous.

Now think about the present situation:

In my village almost all are engaged in some kind of activity. Enough number of two wheelers are roaming around streets and the number of four wheelers now resembles the number of cycles of that time. Again, we are not hearing about starvation deaths anywhere in Odisha. During the 70s/80s starvation deaths were quite common in Odisha. Now the village farmer has his two-wheeler to carry vegetables to nearby cities and sell them daily. It is also not necessary to make distressed sales to a middleman as they are daily selling their agricultural produce at nearby cities. One could witness now huge numbers of motorbikes moving from villages in the morning towards the city and the same rush is visible in the evening towards villages from cities. Roads are now quite good; bus communications are plentifully available. Whatever migration is happening is for earning more. Now most of the Malayali’s (people from Kerala) are migrating to the Middle East for better income. Similarly, most of the Odia’s are now migrating to Kerala to fill the job vacuum created due to migration of Malayali’s to the Middle East.

The village that once echoed with the sound of a few bicycles now buzzes with the energy of motorcycles carrying farmers to nearby cities. The distress sales to middlemen once a heart-breaking necessity have become a thing of the past. Our farmers now have choices, mobility, and most importantly, dignity in their transactions.

Now the focus of the nation is on developing the SME sector. Huge growth has been achieved in the services sector as the service sector constitutes around 60% of the growth in GDP. The focus of the government is on attracting private sector investment and reducing government investment. Huge employment opportunities were created in the services sector after 1991 when reforms were introduced in the Indian Economy. The SME sector was also able to create huge employment, but it is not happening due to an uneven atmosphere thereat.

The economic liberalization of 1991 didn’t just change policies it transformed dreams. The same government that once monopolized employment now actively courted private investment, creating opportunities we couldn’t have imagined in those early days.

The Numbers Tell the Story

The transformation I witnessed in my village wasn’t an isolated miracle it was part of a national renaissance. The data reveals the magnitude of this change:

Poverty Eradication: A National Success Story

The present poverty data as per the recent world Bank Report is as under:

India’s extreme poverty rate dropped to 5.3 per cent in 2022-23 from 27.1 per cent in 2011-12, according to the latest estimates released by the World Bank. The decline amounts to 269 million people moving above the international poverty threshold over an 11-year period.

The number of individuals classified as living in extreme poverty fell from 344.47 million in 2011-12 to 75.24 million in 2022-23. The assessment is based on the $3.00 per day poverty line (in 2021 purchasing power parity terms).

Think about this: 269 million people nearly the entire population of the United States lifted above the poverty line in just eleven years. Behind each statistic is a story like mine, like my village’s, like countless Indian families who dared to dream of a better tomorrow.

The data indicates that five states Uttar Pradesh, Maharashtra, Bihar, West Bengal, and Madhya Pradesh accounted for 65 per cent of India’s extreme poor in 2011-12. These same states contributed to two-thirds of the overall reduction in poverty by 2022-23.

According to the World Bank, rural extreme poverty dropped from 18.4 per cent to 2.8 per cent during the period, while urban extreme poverty decreased from 10.7 per cent to 1.1 per cent.

At the earlier $2.15 per day poverty line (based on 2017 prices), the extreme poverty rate was recorded at 2.3 per cent in 2022, down from 16.2 per cent in 2011-12. In terms of absolute numbers, those living below this line declined from 205.93 million in 2011 to 33.66 million in 2022.

The World Bank data also showed progress in multidimensional poverty. The Multidimensional Poverty Index (MPI) was at 53.8 per cent in 2005-06. It fell to 16.4 per cent in 2019-21 and further to 15.5 per cent in 2022-23.

Government programmes mentioned in the context of poverty reduction include PM Awas Yojana, PM Ujjwala Yojana, Jan Dhan Yojana, and Ayushman Bharat. These initiatives cover sectors such as housing, clean cooking fuel, financial inclusion, and healthcare access.

Systems like Direct Benefit Transfer (DBT), digital services expansion, and rural infrastructure development have also been cited as mechanisms enabling more targeted delivery of benefits.

Banking: From Credit Squeeze to Digital Revolution

Remember the “credit squeeze” I mentioned from my early banking days? Today’s banking landscape would be unrecognizable to that young banker who carefully rationed every loan.

The Digital Banking Renaissance

The present Banking scenario as per the recent report is as under:

The Banking industry in India has historically been one of the most stable systems globally, despite global upheavals. The government has consistently strived to promote financial inclusion through various initiatives targeted to bring the country’s underbanked population under the banking gamut.

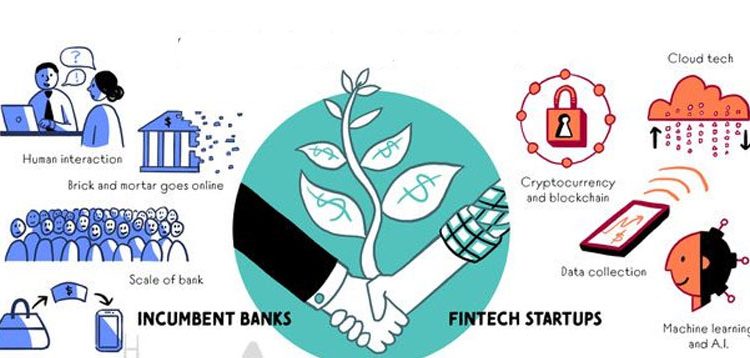

Indian Fintech industry currently is valued at Rs. 9,61,593 crore (US$ 111 billion) and estimated to be at Rs. 36,47,123 crore (US$ 421 billion) by 2029. India has the 3rd largest FinTech ecosystem globally. There are currently more than 2,000 DPIIT-recognized Financial Technology (FinTech) businesses in India, and this number is rapidly increasing.

From a handful of government banks to a thriving ecosystem of 2,000+ fintech companies this transformation mirrors the journey from those few bicycles in my village to today’s bustling motorcycle highways.

The Indian banking system consists of 13 public sector banks, 21 private sector banks, 44 foreign banks, 12 Small finance banks.

As of June 2024, the total number of micro-ATMs in India reached 15,17,580. Moreover, there are 1,26,772 on-site ATMs and Cash Recycling Machines (CRMs) and 90,142 off-site ATMs and CRMs. 100% of new bank account openings in rural India are being done digitally.

The UPI Revolution: A Personal Victory

In December 2024, Unified Payments Interface (UPI) transactions saw a record 8% MoM growth, reaching 16.73 billion transactions worth Rs. 23.25 trillion (US$ 271.96 billion), the highest since its launch in 2016.

When I see farmers in my village using UPI to sell their vegetables, I’m reminded of how far we’ve come. The same farmers who once waited for the weekly bus to Berhampur now conduct digital transactions worth trillions. It’s not just technological progress it’s social transformation.

Immediate Payment Services (IMPS) transactions rose by 9% to 467 million, with a value increase of 11% to approximately Rs. 6,29,000 crore (US$ 74.7 billion), and FASTag transactions grew by 8% in both volume (345 million) and value, reaching around Rs. 6,115 crore (US$ 733 million). The Aadhaar Enabled Payment System (AePS) recorded 126 million transactions, up 26% in volume and 35% in value, totalling approximately Rs. 32,493 crore (US$ 3.88 billion), reflecting strong growth across various digital payment methods.

Financial Inclusion: The Dream Realized

The Indian digital consumer lending market is projected to surpass Rs. 62,37,360 crore (US$ 720 billion) by 2030, representing nearly 55% of the total Rs. 1,12,61,900 crore (US$ 1.3 trillion) digital lending market opportunity in the country.

The credit squeeze that once defined my banking career has been replaced by a lending boom that would have been inconceivable in those early days.

In 2024, total assets in the public and private banking sectors were Rs. 16,128,080 crore (US$ 1,861.72 billion) and Rs. 1,09,52,458 crore (US$ 1,264.28 billion), respectively. Assets of public sector banks accounted for 59.53% of the total banking assets (including public, private sector and foreign banks).

The interest income of public banks reached Rs. 11,09,730 crore (US$ 128.1 billion) in 2024. In 2024, interest income in the private banking sector reached Rs. 8,29,049 crore (US$ 95.7 billion).

Digital payments have significantly increased in recent years, because of coordinated efforts of the Government and RBI with all the stakeholders, UPI volume for FY25 (until June) recorded to 2,762. India accounts for nearly 46% of the world’s digital transactions (as per 2022 data). As on July 2024, there were 602 banks actively using UPI.

The Mobile Revolution

India’s mobile wallet industry is witnessing exponential growth, with a projected CAGR of 23.9% between 2023 and 2027.

When I think about those early days when a bicycle was a luxury, and compare it to today where mobile wallets are growing at 23.9% annually, I’m struck by the pace of change. It’s not just about technology it’s about democratizing financial services for people who were once excluded from the formal economy.

Innovation Continues: Building Tomorrow

The journey continues with ground-breaking innovations:

On November 6, 2024, RBI Deputy Governor Mr. T. Rabi Sankar launched the Unified Lending Interface (ULI) at the Business Standard BFSI Summit in Mumbai. The ULI aims to democratize access to credit for the private sector, similar to how the Unified Payments Interface (UPI) transformed digital payments.

The ULI promises to do for lending what UPI did for payments democratize access and eliminate barriers. For someone who witnessed the credit squeeze era, this represents a complete philosophical transformation in how we think about financial access.

According to the BCG Banking Sector Roundup Report of 9M FY23, credit growth is expected to hit 18.1% in FY23. BCG predicts that the proportion of digital payments will grow to 65% by 2026.

According to RBI’s Scheduled Banks’ Statement, deposits of all scheduled banks collectively surged by a whopping Rs. 2,28,91,936 crore (US$ 2,626.13 billion) as on January 10, 2025.

According to data released by the National Payments Corporation of India (NPCI), UPI transactions volume reached 13,115 crore in FY2024.

Global Expansion: Taking India to the World

Indian tourists in the UAE will soon be able to use UPI payments at more merchant locations, starting with Dubai Duty-Free. This initiative will enhance cross-border transactions, benefiting over 12 million Indian visitors annually.

From a village where international travel was unimaginable to Indians using UPI globally this journey encapsulates India’s transformation from an inward-looking economy to a global digital leader.

Google India Digital Services (P) Limited and NPCI International Payments Ltd. (NIPL), have signed a Memorandum of Understanding (MoU) on 17th January 2024 to expand the transformative impact of UPI to countries beyond India.

Serving Those Who Served

The Defence Accounts Department (DAD) has entered Memoranda of Understanding (MOUs) with four banks in New Delhi. This partnership will establish SPARSH [System for Pension Administration (Raksha)] Service Centres at 1,128 branches of these four banks nationwide. It aims to enhance last-mile connectivity for pensioners, particularly in remote regions.

This initiative resonates deeply with me. Having worked in rural banking, I understand the challenges faced by pensioners in remote areas. The SPARSH system ensures that those who served our nation receive the dignity and convenience they deserve in their retirement.

Agricultural Finance: Full Circle

Warehousing Development Regulatory Authority and Punjab & Sind Bank signed Memorandum of Understanding to facilitate low interest rate loans to farmers on February 5, 2024.

The RBI has launched a pilot to digitalize KCC lending in a bid for efficiency, higher cost savings, and reduction of TAT. This is expected to transform the flow of credit in the rural economy.

Digitalization of Agri-finance was conceptualized jointly by the Reserve Bank and the Reserve Bank Innovation Hub (RBIH). This will enable delivery of Kisan Credit Card (KCC) loans in a fully digital and hassle-free manner.

Seeing agricultural finance being digitized brings my story full circle. The farmers I served in those early days, who struggled for basic credit, now have access to digital lending platforms that process loans faster than we could have imagined.

The Pradhan Mantri Jan Dhan Yojana: Financial Inclusion Realized

The Government of India has been supportive of the banking sector in the country, especially on the financial inclusion agenda. A flagship program, the Pradhan Mantri Jan Dhan Yojana (PMJDY), was launched in August 2014 which aims to provide universal banking services to the unbanked by setting up bank accounts for them and issuing payment cards to all. As of 2023-24, the number of bank accounts opened under the government’s flagship financial inclusion drive ‘Pradhan Mantri Jan Dhan Yojana (PMJDY)’ reached over 51.11 crore beneficiaries and deposits in the Jan Dhan bank accounts totaled over Rs. 2,17,701 crore (US$ 25.13 billion) till December 15, 2023.

51.11 crore bank accounts this number represents more than just financial inclusion; it represents dignity, hope, and opportunity for millions who were once excluded from the formal banking system.

The Digital Revolution Continues

India strengthens banking sector with ‘Baanknet,’ a unified e-auction platform enhancing PSB recoveries, transparency, and credit availability.

In March 2023, India Post Payments Bank (IPPB), in collaboration with Airtel, announced the launch of WhatsApp Banking Services for IPPB customers in Delhi.

In October 2022, Prime Minister Mr. Narendra Modi inaugurated 75 Digital Banking Units (DBUs) across 75 districts in India.

The Future Framework

In Union Budget 2023, a national financial information registry would be constructed to serve as the central repository for financial and ancillary data.

In the Union Budget 2023, the KYC process will be streamlined by using a ‘risk-based’ strategy rather than a ‘one size fits all’ approach.

Meanwhile, to respond to the impact of COVID-19, the government implemented various policies to aid the banking sector.

Rising income is expected to enhance the need for banking services in rural areas, and therefore, drive the growth of the sector.

The Lending App Revolution

India is the world’s largest market for Android-based mobile lending apps, accounting for ~82% of all online lenders worldwide. India currently has 887 active lending apps.

From a credit squeeze to 887 lending apps this transformation represents one of the most dramatic shifts in financial services globally.

The Digital Payments Legacy

The digital payments revolution will trigger massive changes in the way credit is disbursed in India. Debit cards have radically replaced credit cards as the preferred payment mode in India after demonetisation. In December 2022, Unified Payments Interface (UPI) crossed 7.82 billion transactions worth Rs. 12,82,000 crore (US$ 146.48 billion).

Digital modes of payments have grown by leaps and bounds over the last few years. As a result, conventional paper-based instruments such as cheques and demand drafts now constitute a negligible share in both volume and value of payments. In November 2022, RBI launched a pilot project on Central Bank Digital Currency (CBDC). The platform is called NDS-OM CBDC. The Central bank stated that the use case for the wholesale digital rupee is for the “settlement of secondary market transactions in government securities ” as it would reduce transaction costs.

Conclusion: A Personal and National Transformation

As I reflect on this journey from a village with a few bicycles to a nation leading the global digital payments revolution I’m filled with awe at what we’ve accomplished together. My personal story of moving from a scholarship-dependent student to a banker serving rural communities is inseparable from India’s larger narrative of transformation.

The starvation deaths that once haunted Odisha are now history. The credit squeeze that defined my early banking career has given way to a lending boom. The farmers who once made distressed sales to middlemen now use UPI to transact directly with urban markets.

This isn’t just an economic transformation it’s a story of human dignity restored, dreams realized, and a nation that refused to accept that poverty and exclusion were permanent conditions.

Today, as I see young entrepreneurs building fintech companies worth billions, as I watch farmers using digital payments, as I witness 51 crore Jan Dhan accounts enabling financial inclusion, I’m reminded that the best stories are not just about individual success they’re about lifting entire communities, entire nations, toward a more prosperous and equitable future.

The bicycles of my childhood have become motorcycles/Cars. The credit squeeze has become a credit boom. The excluded have become included. This is India’s story and it’s far from over.

Asst General Manager

SBI Local Head Office

Bhubaneswar