Bhubaneswar(Kalinga Voice):Mr. Ganga Nayak, an old age pension beneficiary of Kathakhunta village of Narasinghpur block, Cuttack narrates ‘I used to avail another person’s services to undertake banking transactions in the nearest bank branch several kilometres away thereby spending a significant amount from the pension just for withdrawal of money. I was never aware of such customer-friendly services offered by Business Correspondent Agents (BCAs) to citizens in remote areas. I wholeheartedly thank the State Government for making such arrangements to provide banking services to senior citizens with restricted mobility at the doorstep.’

Confident Ms. Saraswati Mahalik, acting as BCA in the same village of Cuttack district says ‘During the Covid-19 pandemic, the much-needed banking services provided to people in our locality has been a great respite to them. Since being engaged as a BCA, I have been able to contribute significantly towards my household income. I am honoured to be a member of this brigade of financial service providers helping common citizens avail critical financial services at doorstep thereby overcoming challenges of remoteness’. Since April 2021, she has undertaken transactions worth more than Rs. 73 lakh.

Now the senior citizens of Kathakhunta Gram Panchayat, mostly beneficiaries of different social welfare programmes, do not have to walk long distances to avail banking services. The BCA provides banking services at the doorstep of the differently abled persons and senior citizens helping them immensely.

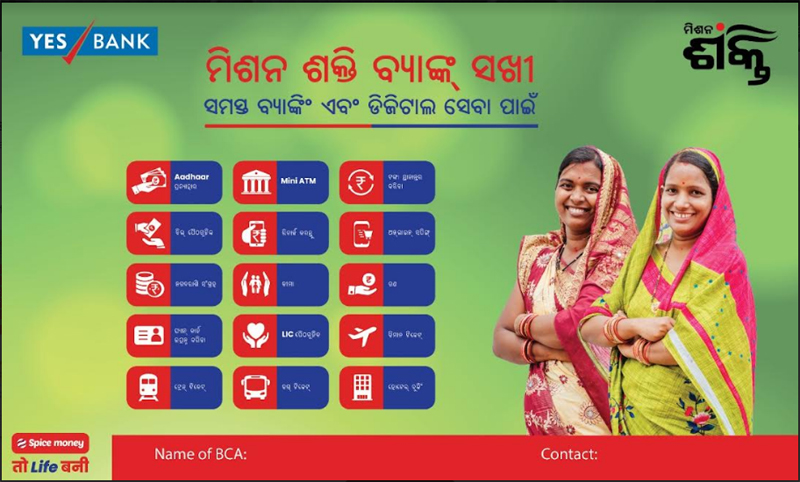

Access of common citizens to banking services in the unbanked Gram Panchayats (GPs) of Odisha has been a mammoth challenge for Government. In collaboration with banking partners, Government made a historic decision of engaging women SHG/Federation members in the banking sector as Business Correspondent Agents (BCAs) for last mile delivery of banking services in unbanked & under-banked GPs. This initiative aims at furthering the financial inclusion efforts in Odisha using ICT-based Business Correspondence Model through community institutions such as members of the SHGs and their federations. Department of Mission Shakti has tied up with two banks for engaging suitable women SHG/federation members as BCAs and issued guidelines for selection of SHG members as BCA. This initiative demonstrates the effective convergence of financial inclusion strategies and the SHG movement under Mission Shakti.

18-45 years aged SHG members with minimum matriculation qualification & basic computer / smartphone operating knowledge are promoted to take up this innovative livelihood business solution for provisioning of banking services in unbanked and under-banked GPs. In partnership with State Bank of India, Yes Bank, ICICI Bank, Utkal Gramya Bank & Odisha Gramya Bank, 1252 Mission Shakti SHG members have been engaged as BCAs in the unbanked GPs across the state.

Financial support for device procurement for these BCAs has been received from State Government and NABARD. To ensure financial sustainability of BCAs, each BCA has been provided with an incentive of Rs. 2000 per month during the first six months of engagement since inception.

Aiming at increasing the outreach of Banking Services such as savings, deposit, withdrawal, remittances, insurance etc. and improving the quality & effectiveness of financial services in rural areas, this transformative livelihood model is a key milestone in promotion of SHG women managed financial inclusion initiatives. This initiative has further empowered SHG federation and SHG members by functioning as BCA, established a sustainable BC network to offer banking services in un/underbanked GPs in rural areas and integrated the SHG based transactions with ICT -based Micro ATM operated by BCAs.

The doorstep banking services rendered by BCAs even following Government’s health advisories during the challenging times of Covid-19 pandemic has been commendable. So far 1252 BCAs have undertaken transactions amounting to Rs. 230 crore. The average monthly income of a BCA ranges from Rs. 3,000 to Rs. 15,000.

Mrs. Chandamani Chand acting as a BCA in Rajendrapur GP under Bhandaripokhari block of Bhadrak district facilitates financial transactions of beneficiaries relating to different Government schemes such as Kalia Yojana, Mamata, labour card etc. with a cumulative transaction of more than Rs. 67 lakh so far.

Women’s empowerment is one of the top priorities of Government of Odisha to strengthen local economies, promote women led entrepreneurship, ensure gender equity and create unique identity of women. The 5T mandate has further facilitated timely decision-making process, teamwork on convergence mode, adoption of transparency measures and integration of technology, paving way for transformative change in women empowerment in Odisha. Engagement of SHG members under BC model truly complements the silent socioeconomic revolution of women in the state supported by enabling policies, unique convergence platform and responsive governance.