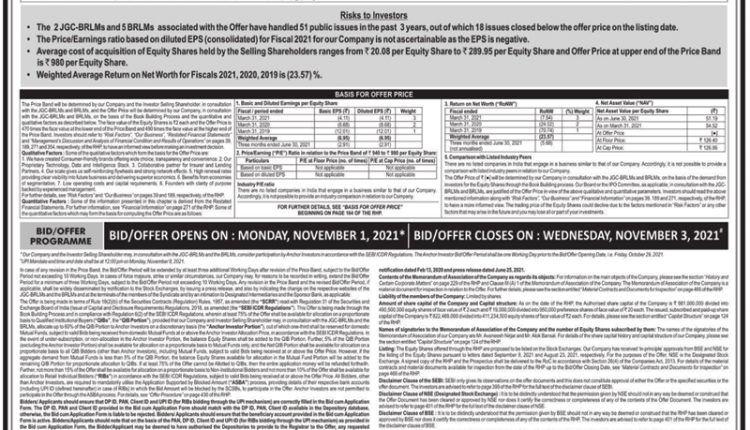

- Price Band fixed at ₹940 to ₹980 per Equity Share of face value of ₹2 each of PB Fintech Limited

- Offer to remain open from Monday, November 01, 2021 to Wednesday, November 03, 2021

- Bids can be made for a minimum of 15 Equity Shares and in multiples of 15 Equity Shares thereafter

Mumbai : PB Fintech Limited (the “Company”), which have built India’s largest online platform for insurance and lending products leveraging the power of technology, data and innovation, according to Frost & Sullivan, plans to open its Initial Public Offering (the “Offer”) on November 01, 2021.

The Price Band of the Offer has been fixed at ₹940 to ₹980 per Equity Share of face of ₹2 each. Bids can be made for a minimum of 15 Equity Shares and in multiples of 15 Equity Shares thereafter.

The Offer consists equity shares of face value of ₹2 each of PB Fintech Limited comprising a fresh issue of aggregating up to ₹37,500 million (the “Fresh Issue”) and an offer for sale comprising up to ₹18,750 million by SVF Python II (Cayman) Limited (the “Investor Selling shareholder”) and equity shares by certain persons listed in this Red Herring Prospectus (the “Other Selling Shareholders*”).

The Company provides convenient access to insurance, credit and other financial products and aim to create awareness amongst Indian households about the financial impact of death, disease and damage. Through their consumer-centric approach, PB Fintech Limited seek to enable online research-based purchases of insurance and lending products and increase transparency, which enables Consumers to make informed choices. They also facilitate their Insurer and Lending Partners in the financial services industry to innovate and design customised products for Consumers leveraging extensive data insights and data analytics capabilities.

The Net Proceeds from the Fresh Issue are proposed to be utilised for (i) Enhancing visibility and awareness of brands, including but not limited to “Policybazaar” and “Paisabazaar”; (ii) New opportunities to expand Consumer base including offline presence; (iii) Strategic investments and acquisitions; (iv) Expanding presence outside India; and (v) General corporate purposes.

The Equity Shares offered in this Offer are proposed to be listed at both BSE Limited (“BSE”) and the National Stock Exchange of India Limited (“NSE”, together with BSE, the “Stock Exchanges”) post the listing.

Kotak Mahindra Capital Company Limited^, Morgan Stanley India Company Private Limited^, Citigroup Global Markets India Private Limited, ICICI Securities Limited, HDFC Bank Limited, IIFL Securities Limited and Jefferies India Private Limited are the Book Running Lead Managers to the Offer.